Do you know when you will retire?

If you have an age in mind for retirement, and a financial plan to back it up, you are ahead of many Americans who have little or no retirement plan to speak of. That said, recent data suggests that the age we think we will retire is not accurate: Actual retirement can come sooner than expected.

Good news?

That depends on whether you are prepared to retire earlier than planned. Increasingly, Americans (and especially women) are advised to work into later years to shore up retirement funds, but this may be in direct contrast to the reality that many

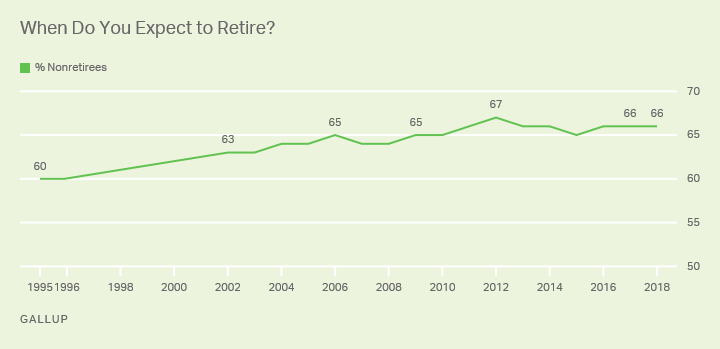

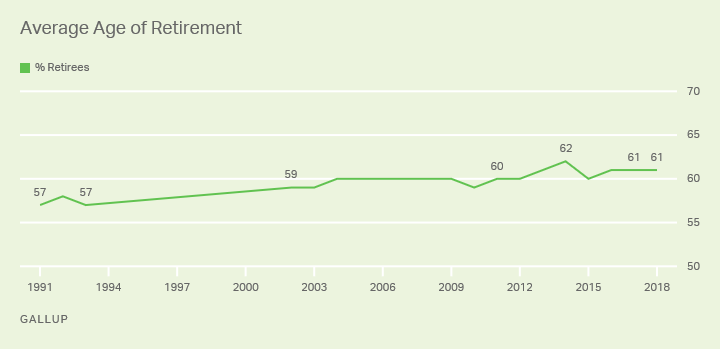

Though Americans are in fact retiring later than in the recent past, the expected age for retirement has also risen. This disconnect can result in greater risk of a financially insecure retirement.

In this

The Case for Delayed Retirement

As noted in prior blog entries, women face a greater number of obstacles to successful retirement than their male counterparts. Despite more woman participating in the job market, increasingly they take time off due to rising

Since an individual's social security benefit is calculated from the top 35 years of earnings, delaying retirement and late-career earnings can significantly increase one’s social security benefit. According to The Center for Retirement Research at Boston College:

Women

Additionally, delay of retirement increases the number of years of saving and investing in retirement accounts, extends health insurance, and reduces the

Americans are trending toward a later retirement age. In the early 1990s,

All this said, there are times when delaying retirement or collecting social security is not the best option or is not possible. And as recent evidence indicates, many Americans retire earlier than they planned.

The Reality of Earlier Retirement

According to a recent article by David M. Blanchett, "A growing body of research notes that retirement age projections are inconsistent with actual retirement age decisions -- people tend to retire earlier than expected.”

The disparity between

Source: Snapshot: Average American Predicts Retirement Age of 66, https://news.gallup.com/poll/234302/snapshot-americans-project-average-retirement-age.aspx

An earlier than expected retirement may be welcome if one has prepared for it, otherwise, it may be an unavoidable hardship. Of those retiring earlier than expected, the majority cited health problems, job loss, or caring for a spouse or another family member. Only about 1/3 reported being able to afford to retire or wanting to do something else. Health problems are the most common factor in earlier retirement especially for men

Based on the data, Blanchett suggests that a prudent approach is to set one’s target retirement age earlier to encourage saving at a higher rate. By recalibrating the age of retirement, one’s likelihood of financial security will be greater should there be an unexpected event that forces an early exit from the workforce.

How To Plan For An Uncertain Retirement

For some, the goal to delay retirement is out of financial necessity, for others it is preference. The recession in 2008, high debt levels, and a shift away from guaranteed pensions to 401(k) plans, has resulted in less well-funded retirements for many. However, the delay

However, if life should throw one of its inevitable curve balls, you may be better served by having a financial plan that envisions an earlier retirement to promote healthier retirement accounts.

According to Blanchett, 61 seems to be the most predictive age for retirement. “individuals targeting retirement before age 61 tend to retire later than expected, and those targeting retirement at an age after 61 generally retire approximately a half-year early for each additional year targeting past age 61.” In the hypothetical, if you plan to retire at around age 69, you are likely to retire around age 65.

Meet with a planner to run various scenarios of when you might retire. Savings goals should consider more than one possible retirement age and be specific to your personal circumstances. Health is one of the primary drivers for earlier than expected retirement. So if there is a medical history for you or a loved one, it should be factored into the assumptions of your plan.

If you do have to retire before your full social security benefit is reached, talk to an advisor about strategies to bridge the gap between retirement and withdrawing social security to maximize your benefit.

The more you know the more prepared you can be; and whatever path you take, a financial plan will get you further.

(1) Do Late-Career Wages Boost Social Security More For Women Than Men? Matthew S. Rutledge and John E. Lindner, CRR WP 2016-13, November 2016 http://crr.bc.edu/wp-content/uploads/2016/11/wp_2016-13.pdf

(2) Average U.S. Retirement Age Rises To 62, https://news.gallup.com/poll/168707/average-retirement-age-rises.aspx; Snapshot: Average American Predicts Retirement Age of 66, https://news.gallup.com/poll/234302/snapshot-americans-project-average-retirement-age.aspx

(3) The Impact of Retirement Age Uncertainty on Retirement Outcomes, David M. Blanchett, Ph.D., CFA, CFP, https://www.onefpa.org/journal/Pages/SEP18-The-Impact-of-Retirement-Age-Uncertainty-on-Retirement-Outcomes.aspx